A monthly budget is a financial plan that helps you track your income and expenses, allowing for better financial management, increased savings, and reduced debt. Regular reviews and adjustments ensure it aligns with your goals, while budgeting tools can aid in the process. Long-term benefits include financial security and improved spending habits.

A monthly budget is essential for achieving financial success and stability. By tracking your income and expenses, you can take control of your finances and work towards your financial goals. This article will guide you through creating an effective monthly budget that fits your lifestyle, offers tips for sticking to it, and highlights common mistakes to avoid.

All Contents

- 1 Understanding the Importance of a Monthly Budget

- 2 Why a Monthly Budget Matters

- 3 How to Create a Monthly Budget

- 4 Step 1: Gather Financial Information

- 5 Step 6: Monitor and Adjust

- 6 Tips for Sticking to Your Monthly Budget

- 7 Tip 1: Set Clear Goals

- 8 Tip 6: Use Budgeting Tools

- 9 Adjusting Your Monthly Budget for Changing Circumstances

- 10 Identify Changes in Income

- 11 Monitor Your Adjusted Budget

- 12 Common Budgeting Mistakes to Avoid

- 13 Not Tracking Your Spending

- 14 Relying Too Heavily on Credit

- 15 Tools and Apps for Monthly Budgeting

- 16 1. Mint

- 17 6. Personal Capital

- 18 Incorporating Savings into Your Monthly Budget

- 19 1. Pay Yourself First

- 20 6. Include an Emergency Fund

- 21 Debt Repayment Strategies Within a Monthly Budget

- 22 1. List All Debts

- 23 6. Avoid New Debt

- 24 Best Practices for Reviewing Your Monthly Budget

- 25 1. Set a Review Schedule

- 26 6. Make Necessary Adjustments

- 27 Long-Term Benefits of a Monthly Budget

- 28 1. Improved Financial Management

- 29 6. Better Spending Habits

- 30 In Summary: The Importance of a Monthly Budget

- 31 FAQ – Frequently Asked Questions About Monthly Budgeting

Understanding the Importance of a Monthly Budget

Understanding the importance of a monthly budget is a crucial step in achieving financial stability and success. A monthly budget serves as a plan that helps you track your income and expenses, enabling you to make informed financial decisions.

Why a Monthly Budget Matters

Having a monthly budget provides several benefits:

- Control over Finances: A budget gives you a clear picture of where your money is going, helping control needless spending.

- Goal Achievement: Setting aside money for goals like savings or debt repayment becomes easier when you have a structured plan.

- Debt Management: A well-structured budget helps allocate funds monthly toward debt repayment, assisting in your path to financial freedom.

- Emergency Preparedness: Creating a budget encourages setting aside an emergency fund for unexpected expenses.

Establishing Financial Discipline

Understanding how to maintain financial discipline is vital when following your monthly budget. You should:

- Track Spending: Keep receipts or use financial apps to monitor your expenses.

- Prioritize Needs vs. Wants: Identify necessary expenditures and differentiate them from discretionary spending.

“A budget is telling your money where to go instead of wondering where it went.” – John C. Maxwell

Key Takeaways

A monthly budget is not just about limiting your spending; it’s about empowering you to make skilled financial choices. Knowing where your money goes each month helps establish financially supportive habits. The journey towards financial wellness starts with this knowledge.

How to Create a Monthly Budget

Creating a monthly budget is easier than you think. Follow these steps to get started on your financial journey:

Step 1: Gather Financial Information

Begin by collecting all your financial documents. This should include:

- Your income statements

- Bank statements

- Credit card bills

- Other monthly expenses

Step 2: Identify Your Income

List all sources of income, such as:

- Salary

- Side gigs

- Investments

- Other income streams

This total will be your monthly income for budgeting purposes.

Step 3: List Your Monthly Expenses

Make a comprehensive list of all your monthly expenses. Be sure to categorize them:

- Fixed Expenses: These do not change monthly, like rent or mortgage payments.

- Variable Expenses: These can vary, like groceries and entertainment.

Step 4: Set Your Financial Goals

Decide on short-term and long-term goals:

- Short-term: Save for a vacation or pay off credit card debt.

- Long-term: Save for retirement or a new home.

Step 5: Create Your Budget

Subtract your total expenses from your total income. Ensure you have funds left for savings and goals. A basic monthly budget formula is:

Income – Expenses = Remaining Amount

Step 6: Monitor and Adjust

Each month, track your spending to see if you’re following your monthly budget. Adjust as necessary to meet your financial goals. If you find any overages, pinpoint where to cut back.

Step 7: Use Budgeting Tools

Consider using apps or spreadsheets to keep track of your monthly budget. These tools help you visualize your financial situation and make adjustments easier.

Tips for Sticking to Your Monthly Budget

Sticking to your monthly budget can be challenging, but with the right strategies, you can manage your finances effectively. Here are some practical tips:

Tip 1: Set Clear Goals

Establish clear financial goals to stay motivated. Consider:

- Short-term goals like saving for a vacation

- Long-term goals such as paying off a mortgage or saving for retirement

Tip 2: Use Cash for Discretionary Spending

Using cash can help control spending. Withdraw a set amount for entertainment or dining out. When it’s gone, you can’t spend more.

Tip 3: Review Your Budget Regularly

Check your monthly budget regularly:

- Look for areas where you overspent.

- Adjust your budget as needed for upcoming expenses.

Tip 4: Prepare for Unexpected Expenses

Life is unpredictable, so it’s essential to have a buffer in your monthly budget for unexpected costs:

- Keep an emergency fund for urgent situations.

- Allocate a small portion of your budget to cover surprises.

Tip 5: Limit Impulse Purchases

To avoid impulse buying:

- Make a list before shopping and stick to it.

- Wait 24 hours before making a purchase, to see if you still want it.

“Budgeting isn’t about limiting yourself—it’s about making room for what matters.” – Anonymous

Tip 6: Use Budgeting Tools

Consider using apps or spreadsheets to track your monthly budget easily. Many tools send reminders and alerts for overspending to help you stay on track.

Tip 7: Celebrate Small Wins

Acknowledge your accomplishments in hitting your budget goals. Celebrating small achievements can motivate you to keep going.

Adjusting Your Monthly Budget for Changing Circumstances

Adjusting your monthly budget is essential when circumstances change. Life can throw unexpected expenses or income alterations your way. Here are steps to effectively adjust your budget:

Identify Changes in Income

Start by assessing any changes in your income:

- Did you receive a raise or bonus?

- Have you lost a job or had hours cut?

- Have new income sources emerged, like freelance work?

Evaluate Your Current Expenses

Next, review your current expenses to see where adjustments are needed:

- Identify fixed expenses like rent or mortgages.

- Look at variable expenses such as groceries or dining out.

Adjust Your Categories

Based on your financial situation, adjust your monthly budget categories:

- If income drops, reduce discretionary spending categories.

- If income increases, consider boosting savings and investments.

“Being flexible with your budget helps you adapt to the ups and downs of life.” – Anonymous

Factor in Unexpected Expenses

Sometimes life events require more money:

- Medical expenses

- Home repairs

- Car maintenance

Ensure your monthly budget has space for such surprises by setting aside an emergency fund.

Revisit Your Financial Goals

Regularly review your financial goals:

- Are your goals still realistic?

- Do they align with your current financial situation?

Adjust your budget to reflect any shifts in your goal timelines.

Monitor Your Adjusted Budget

After making changes, continuously monitor your monthly budget:

- Track your spending to make sure you’re staying within limits.

- Make further adjustments as your financial situation evolves.

Common Budgeting Mistakes to Avoid

Avoiding common budgeting mistakes is crucial for achieving financial success. Here are key mistakes to steer clear of:

Not Tracking Your Spending

One of the biggest errors is failing to track your spending:

- Without tracking, you can easily overspend.

- Keep receipts or use apps to monitor your expenses.

Underestimating Expenses

Many people underestimate their expenses:

- Consider all costs, including irregular bills like car maintenance.

- Adjust your monthly budget to include these expenses.

Setting Unrealistic Goals

Avoid setting goals that are too ambitious:

- Make achievable spending limits based on your financial situation.

- Use SMART criteria for setting financial goals.

“Successful budgeting is about balance, not constraint.” – Anonymous

Ignoring Savings

Neglecting to include savings in your monthly budget is a common mistake:

- Set aside a percentage of your income for emergencies.

- Include savings as a fixed expense in your budget.

Not Reviewing Your Budget Regularly

Failing to review your budget can lead to overspending:

- Check your budget monthly and adjust as needed.

- Keep track of goals and progress towards them.

Relying Too Heavily on Credit

Using credit too much can derail your budget:

- Avoid depending on credit cards for everyday expenses.

- Pay off credit card balances each month to avoid charges.

Being Too Hard on Yourself

Lastly, it’s essential to stay positive:

- Don’t beat yourself up for occasional mistakes.

- Learn from them and adjust your monthly budget as necessary.

Tools and Apps for Monthly Budgeting

Using tools and apps for monthly budgeting can make tracking your finances easier and more efficient. Here are some popular options:

1. Mint

Mint is a widely used budgeting app:

- Free to use: Offers a range of features without any costs.

- Expense tracking: Automatically categorizes your expenses.

- Goal setting: Helps you set and monitor financial goals.

2. YNAB (You Need a Budget)

YNAB is a more structured budgeting tool:

- Subscription-based: Comes with a small monthly fee after a free trial.

- Proactive budgeting: Encourages planning for each dollar in your budget.

- Educational resources: Teaches budgeting skills through workshops.

3. PocketGuard

PocketGuard simplifies budgeting:

- Real-time tracking: Connects to your bank account for automatic updates.

- Spending limits: Shows how much you have left to spend after bills and goals.

“Budgeting tools turn chaos into clarity!” – Anonymous

4. EveryDollar

EveryDollar is user-friendly:

- Zero-based budgeting: Allows you to create a budget based on your total income.

- Easy setup: Quick to set up and start budgeting.

5. GoodBudget

GoodBudget is great for envelope budgeting:

- Digital envelopes: Uses a virtual envelope-system for spending categories.

- Cross-platform: Available on both web and mobile.

6. Personal Capital

Personal Capital offers financial planning features:

- Investment tracking: Helps you monitor investments as well as budgets.

- Retirement planning: Provides tools to plan for retirement.

7. Spendee

Spendee caters to group budgeting:

- Shared expenses: Great for managing budgets with friends or family.

- Currency support: Works with multiple currencies for travel budgeting.

Choosing the right tool can simplify the process of managing your monthly budget. Explore these options to find what works best for you.

Incorporating Savings into Your Monthly Budget

Incorporating savings into your monthly budget is essential for financial stability. Here’s how you can do it:

1. Pay Yourself First

Make savings a priority by “paying yourself first.” This means:

- Set aside a portion of your income before paying bills or other expenses.

- This could be a fixed percentage or a set amount each month.

2. Set Specific Savings Goals

Having clear savings goals can motivate you:

- Short-term goals: Save for a vacation or special purchase.

- Long-term goals: Save for retirement or a down payment on a house.

3. Create a Separate Savings Account

Consider opening a separate savings account:

- This makes it easier to track your savings progress.

- It can help prevent the temptation to spend your savings.

“A goal without a plan is just a wish.” – Antoine de Saint-Exupéry

4. Automate Your Savings

Automating savings can simplify the process:

- Set up automatic transfers to your savings account each payday.

- This ensures consistency and helps you reach your goals faster.

5. Review and Adjust Your Budget

Regularly review your monthly budget to make adjustments:

- If your income increases, consider increasing your savings contribution.

- Adjust for any changes in your expenses or financial goals.

6. Include an Emergency Fund

Part of your savings should go toward an emergency fund:

- Aim to save three to six months’ worth of expenses.

- This protects you from unexpected financial setbacks.

7. Track Your Progress

- Use budgeting apps or simple spreadsheets to see how close you are to reaching your goals.

- Celebrate milestones to keep yourself encouraged.

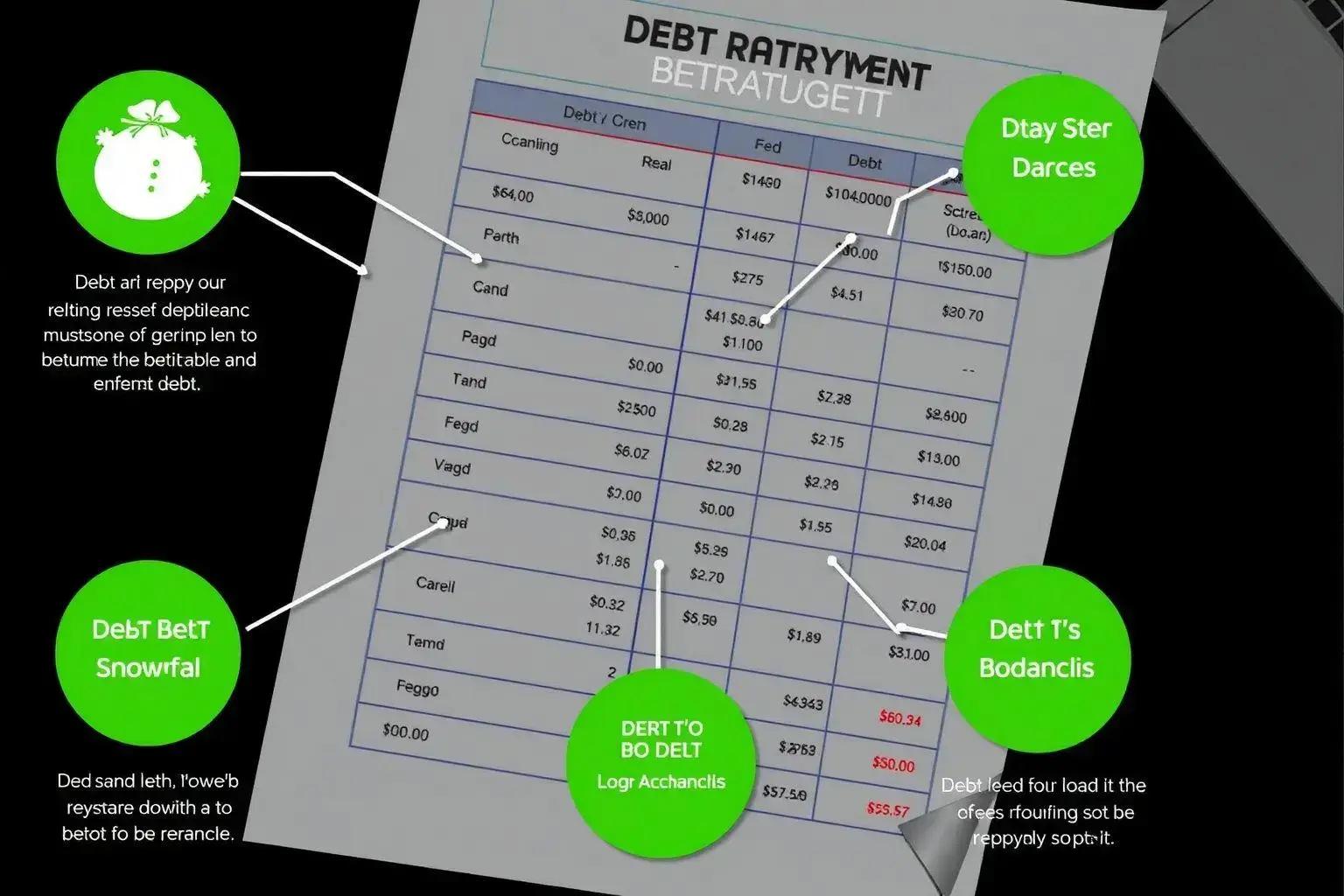

Debt Repayment Strategies Within a Monthly Budget

Managing debt repayment within your monthly budget is essential for financial health. Here are effective strategies to consider:

1. List All Debts

Begin by listing all your debts:

- Include credit cards, loans, and any other obligations.

- Note the interest rates and minimum payments for each debt.

2. Choose a Repayment Strategy

There are various strategies for debt repayment, such as:

- Debt Snowball: Pay off smallest debts first to build momentum.

- Debt Avalanche: Focus on debts with the highest interest rates first.

3. Create a Debt Repayment Plan

Outline a clear plan within your monthly budget:

- Set aside a fixed amount each month for debt repayment.

- Include this amount as a non-negotiable expense in your budget.

“The journey of a thousand miles begins with one step.” – Lao Tzu

4. Consider Extra Payments

If possible, make extra payments toward your debts:

- Use any extra income, like bonuses or tax refunds, to pay down debt.

- Even small extra payments can reduce the principal.

5. Adjust Your Budget as Needed

Review and adjust your budget regularly:

- If you take on more debt, update your repayment strategy.

- If you pay off a debt, redirect that payment to another debt.

6. Avoid New Debt

While paying off existing debt, avoid accumulating new debt:

- Limit credit card usage to emergencies only.

- Consider cash or debit for purchases while budgeting.

7. Seek Help if Necessary

If debt feels overwhelming, consider seeking professional help:

- Credit counseling can provide valuable guidance.

- Debt consolidation might be an option to simplify payments.

Best Practices for Reviewing Your Monthly Budget

Regularly reviewing your monthly budget is essential for financial success. Here are some best practices to follow:

1. Set a Review Schedule

Create a consistent schedule for reviewing your budget:

- Consider doing it at the end of each month.

- Choose a specific day to reflect on your finances.

2. Compare Actual Spending to Budgeted Amounts

Review your actual spending against your budget:

- Identify variances in each category.

- See where you spent more or less than planned.

3. Analyze Changes in Income or Expenses

Check for any changes in your income or expenses:

- Have you received a raise or unexpected expenses?

- Update your monthly budget accordingly.

“Successful budgeting is about making adjustments, not restrictions.” – Anonymous

4. Track Progress Toward Financial Goals

Evaluate how close you are to achieving your financial goals:

- Are you on track to meet savings and debt repayment goals?

- Adjust your budget if necessary to stay on target.

5. Identify Spending Patterns

Look for patterns in your spending habits:

- Are there categories where you consistently overspend?

- Identify areas for potential cutbacks.

6. Make Necessary Adjustments

Adjust your budget based on your review findings:

- Increase or decrease allocations as needed for various categories.

- Consider setting up new savings or debt repayment goals.

7. Use Budgeting Tools

Consider using budgeting apps or spreadsheets:

- These tools can help you streamline your budget review process.

- They often have features for tracking and analyzing spending patterns.

Long-Term Benefits of a Monthly Budget

Establishing a monthly budget comes with numerous long-term benefits that help you achieve financial stability and success. Here are some key advantages:

1. Improved Financial Management

A monthly budget enhances your ability to manage finances:

- Gives you a clear outline of income and expenses.

- Encourages better control over spending habits.

2. Increased Savings

Consistency with budgeting leads to better savings:

- Helps you allocate funds for an emergency fund.

- Encourages setting aside money for future goals.

3. Debt Reduction

Following a budget helps tackle debt:

- Prioritize debt repayment within your budget.

- Decreases reliance on credit over time.

“A budget is telling your money where to go instead of wondering where it went.” – John C. Maxwell

4. Financial Goal Achievement

Long-term budgeting aids in achieving financial goals:

- Sets clear targets for short-term and long-term aspirations.

- Provides motivation as you see progress.

5. Stress Reduction

A monthly budget can reduce financial stress:

- Gives peace of mind knowing you are tracking your finances.

- Helps avoid unpleasant surprises related to bills.

6. Better Spending Habits

With time, budgeting fosters better spending habits:

- Encourages conscious purchasing decisions.

- Helps you learn the difference between needs and wants.

7. Long-Term Financial Security

Ultimately, budgeting leads to long-term financial security:

- Builds a solid foundation for retirement savings.

- Increases your ability to handle unexpected expenses.

In Summary: The Importance of a Monthly Budget

A well-structured monthly budget is a vital tool for achieving financial success. It enhances your ability to manage finances effectively and fosters positive financial habits over time.

By incorporating savings, avoiding common mistakes, and adjusting your budget as circumstances change, you can create a sustainable financial framework. Review your budget regularly to ensure it aligns with your goals and make necessary adjustments.

Ultimately, the long-term benefits of budgeting include increased savings, reduced debt, and improved financial security. By committing to a monthly budget, you empower yourself to make informed decisions and build a more secure financial future.

FAQ – Frequently Asked Questions About Monthly Budgeting

What is a monthly budget?

A monthly budget is a financial plan that outlines your income and expenses for a month, helping you manage your personal finances effectively.

Why is it important to have a monthly budget?

Having a monthly budget helps you track your spending, allocate funds for savings, avoid debt, and achieve your financial goals.

How can I start creating a monthly budget?

Begin by listing all your income sources and fixed and variable expenses. Then, allocate amounts to each category based on your financial goals.

What are some common mistakes to avoid when budgeting?

Common mistakes include not tracking spending, underestimating expenses, setting unrealistic goals, and neglecting to include savings in your budget.

How often should I review my budget?

It’s best to review your budget monthly to assess your progress, make necessary adjustments, and ensure you are on track to meet your financial goals.

What tools can I use for budgeting?

There are various tools and apps available for budgeting, such as Mint, YNAB (You Need A Budget), and PocketGuard, which can help you manage your finances.

Fabricio Henrique is a writer and financial educator committed to simplifying personal finance for beginners.

With a clear and approachable style, he breaks down complex concepts, guiding readers to organize their finances, create budgets, and make informed decisions about savings and investments.

Holding a degree in Economics from The Wharton School at the University of Pennsylvania, Fabricio blends academic expertise with a passion for teaching, delivering practical tips and realistic strategies for those starting their financial journey.

His articles and guides, regularly featured on blogs and specialized platforms, inspire thousands to take control of their money.